Islamic Interbank Market 156-165 159-161 163-164 165-170 170-172. Up to 10 cash back with annual growth rates of between 15 per cent and 20 per cent the assets of the islamic finance sector are expected to reach the us2 trillion mark by the year 2015.

Pdf Challenges And Opportunities Of Islamic Banking And Financial Institutions In Malaysia

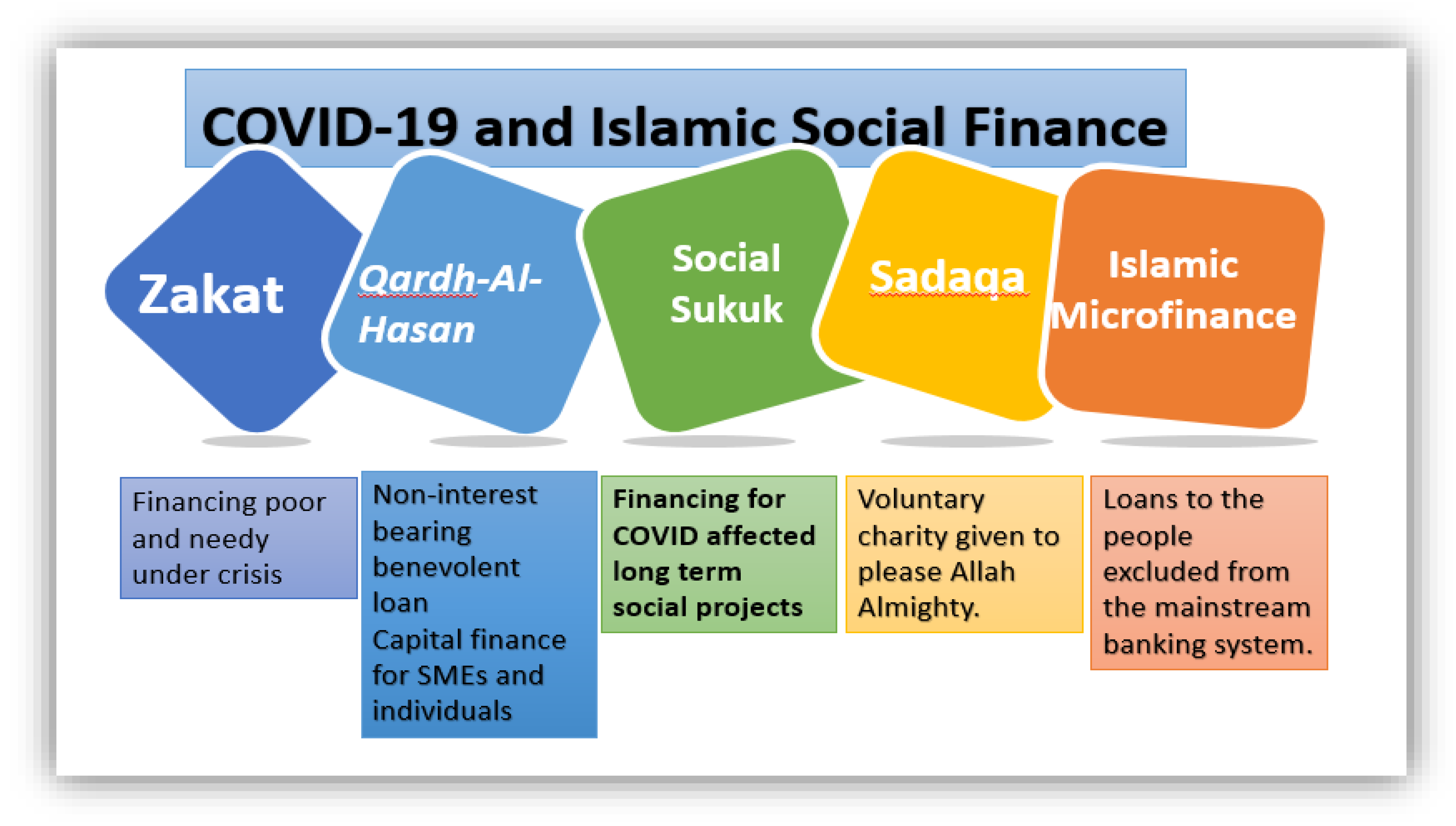

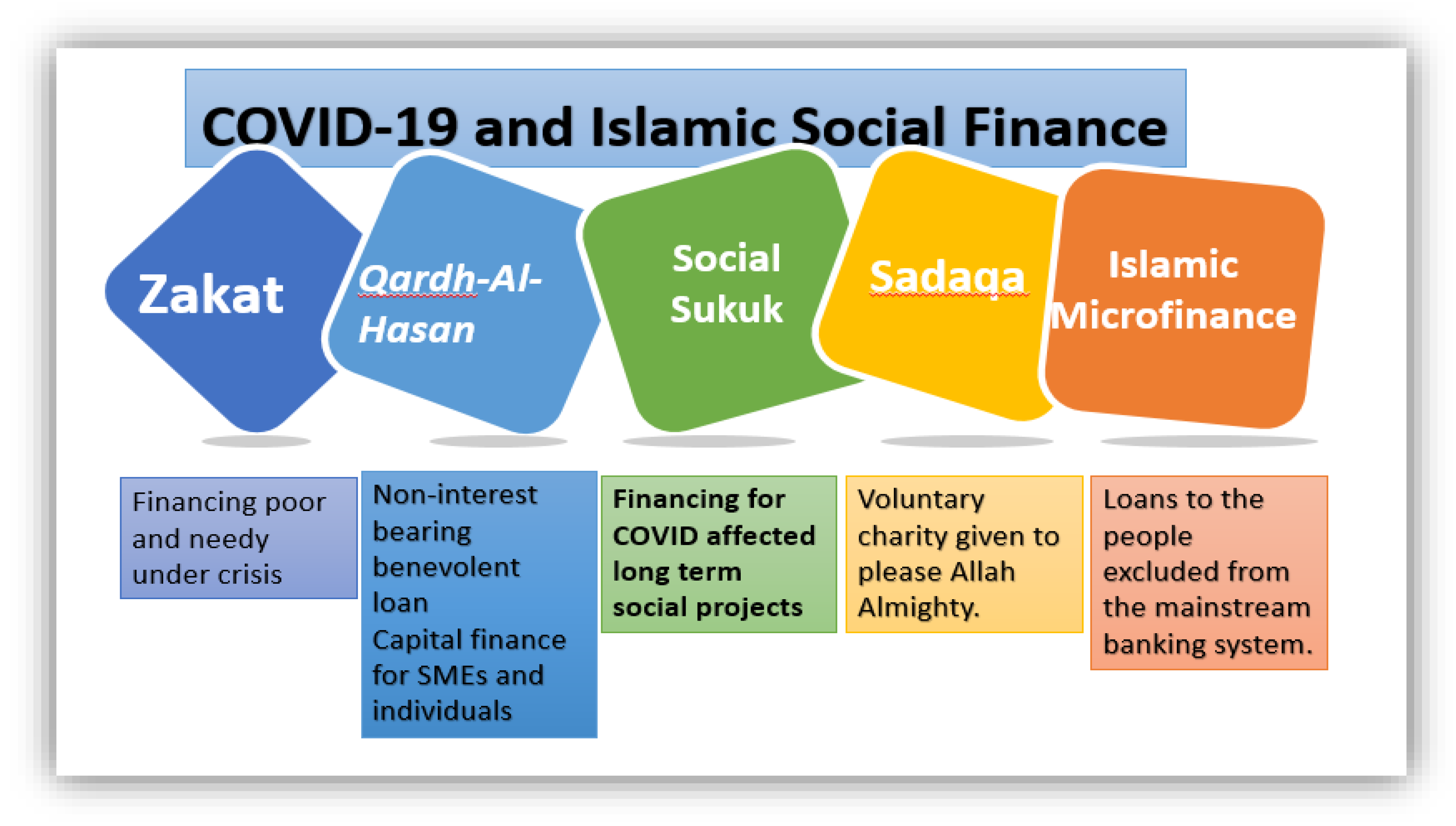

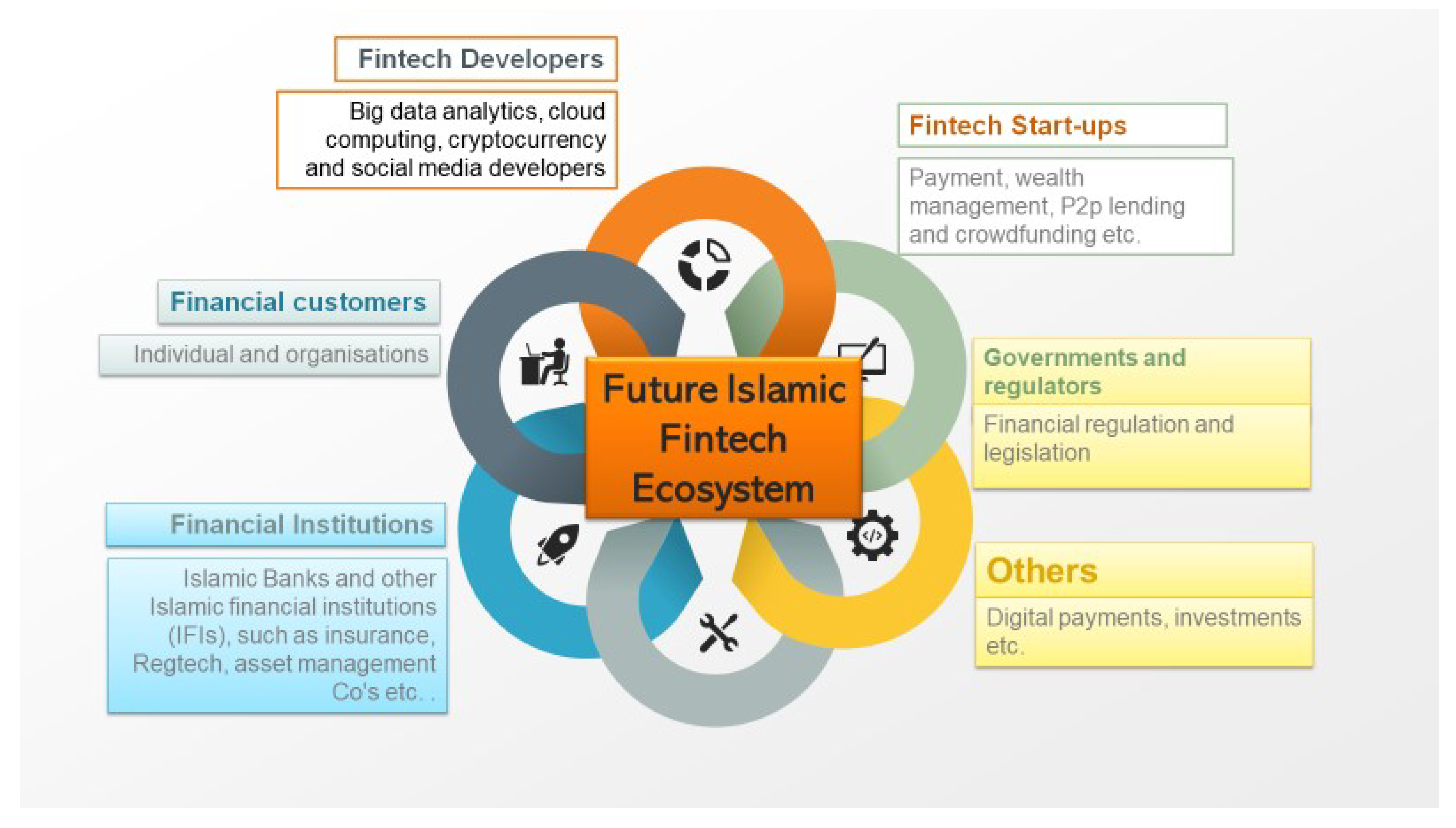

FinTech has fueled a resurgence in Islamic social finance enhancing information access and transparency in making donations through zakat waqf and sadaqah.

. Islamic finance refers to the provision of financial services in accordance with Islamic jurisprudence Shariah3Shariah bans interest Riba4products with excessive uncertainty Gharar gambling Maysir short sales as well as financing of prohibited activities that it considers harmful to society. View Islamic finance challenges in Malaysiadocx from FAFB DBF at Tunku Abdul Rahman University College Kuala Lumpur. In other words on the one hand there is the legal question of whether the existing laws in a secular jurisdiction allow financial transactions to be.

Bridging the technology gap between generations and income segments. Disparity in Theory and Practice. Maximising the Potential of.

2 AprilJune 2008 179 Trends and Challenges in Islamic Finance aspects of Islamic contracts and second the regulatory aspects of Islamic financial transactions. This research is a quantitative study using primary data and was disseminated among the banking authorities of Islamic banking and financial institutions. Islamic finance challenges in Malaysia Challenges that faced by Islamic included.

Most of the literature studies and reports basically mentioned on the general issues and challenges such as political risk legal risk currency and. Of Islamic financial in Malaysia. The Islamic financial system in Malaysia has witnessed a tremendous growth in demand acceptance and development since its introduction in 1963.

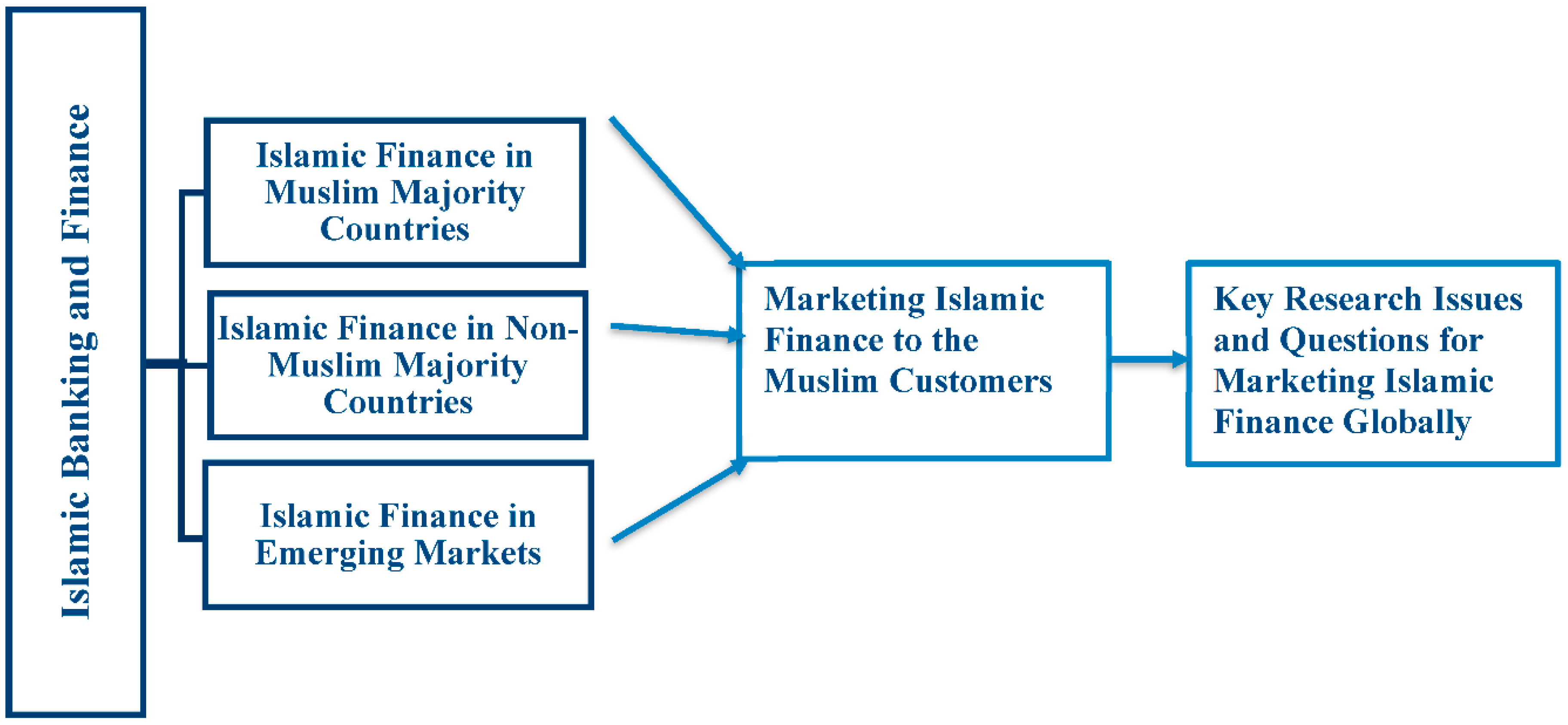

The Islamic Financial System Management of the Islamic Banking System White Box. The increasing globalization of the financial system and the prospects of further liberalization of the banking system in the time to come both domestically and regionally would pose challenges not only to conventional banking institutions but also to Islamic banking. The key beneficiaries of the Islamic financial industry are large financial corporations that raise capital via issuing Islamic equity and governments that diversify their debt composition using shariʿa-compliant bills and bonds.

Analysts say the problem that firms such as HSBC are facing in expanding their Islamic finance business is that different Muslim countries interpret Islamic law differently. 156 MANAGEMENT OF THE ISLAMIC BANKING SYSTEM The Islamic financial system in Malaysia showed significant progress in an increasingly liberalised and. While it was largely unscathed by the GFC due to shariah principles that prohibit speculation and risky asset classes it is not immune this time around.

The establishment of Islamic financial institutions is a major step in addressing this predicament as Islamic finance has been characterized as a body to remove exploitation and injustice. The concepts of Islamic finance were initially discussed in the mid 1940s. The research conducted by Bursa Malaysia 2009 found that there were lacks of awareness of potential investors in Islamic stock market in Malaysia MIFC 2015a.

There seems to be a conflict of priorities whereby most of the Islamic MFIs seek to achieve both the social mission by way of distributing zakat alms and infaq and the economic mission through the distribution of financial loans. Based on the legal infrastructure of the existing Islamic finance including Islamic Banking Act 1983 Act 1984 and Government Funding Act 1983 Malaysia has provided a legal framework for the further development of Islamic. 1 the strong performance of the islamic financial institutions during the global financial crisis has further enhanced the reputation of the sector as a legitimate alternative to.

One of the challenges the Islamic industry faces is a lack of consensus regarding the interpretation and application of Shariah principles resulting in products and transactions that are valid in one country or region but not another. Finance development banking money creation Islam Malaysia shariʿa. Similarly human resource issues such as the quality of management technical expertise and professionalism are also subject to debate.

Goldman Sachs was recently caught in a debate about how Shariah-compliant its 2bn Islamic bond programme is. This sort of priority dilemma then leads to a mission drift in the Islamic MFIs. However Islamic banking and financial institutions are facing some great challenges in the Malaysia because the conventional financial system is more beneficial.

In Malaysia specifically the penetration of Islamic financial industry is low due to lack of awareness and perception toward Islamic financial products and services. Since then BIMB has. Challenges to Islamic finance The Islamic finance industry is no exception.

Government Regulations and Incentives. Three challenges and opportunities remain for FinTech applications driving inclusion in Malaysia. Malaysia continues to thrive and develop this industry by encouraging foreign financial institutions to establish an international Islamic banking business in Malaysia to undertake foreign currency business.

The role of Shariah boards brings unique challenges to the governance of Islamic financial institutions. WORLD ECONOMICS Vol. However further details were only revealed and then practiced in the late 1960s.

Furthermore Islamic finance plays an important role in this country that is accordance with shariah-compliant. It began with the establishment of the Malaysian Pilgrims Fund Board Tabung Haji and the countrys first Islamic bank Bank Islam Malaysia Berhad BIMB which began operations on 1 July 1983. Proponents such as Zeti Akhtar Aziz the head of the central bank of Malaysia have argued that Islamic financial institutions are more stable than conventional banks because they forbid speculation and their two main types banking accounts current account and mudarabah accounts carry less risk to the bank.

Islamic Finance Challenges Opportunities Pakistan Gulf Economist

Workshop On Islamic Finance In The National Accounts Beirut Lebanon Ppt Download

Management For Professionals Management Of Shari Ah Compliant Businesses Case Studies On Creation Of Sustainable Value Hardcover Walmart Com In 2022 Case Study Financial Management Management

Islamic Banking Products Regulations Issues And Challenges Semantic Scholar

Highlights Of Malaysia S Islamic Banking System Http Malaysiafinancialservices Wordpress Com 2013 07 26 What Is Islamic Banking Perbankan Sejarah Tujuan

What Is Islamic Finance And What Can It Do Decision Sciences Institute

Pdf Will It Survive Challenges Faced By Islamic Banking And Finance In Today S World

Fintech Digital Currency And The Future Of Islamic Finance Springerlink

The Inaugural Royal Award For Islamic Finance Impact Challenge Prize 2022

Pdf Trends And Challenges In Islamic Finance

Joitmc Free Full Text Exploring The Role Of Islamic Fintech In Combating The Aftershocks Of Covid 19 The Open Social Innovation Of The Islamic Financial System Html

Joitmc Free Full Text Exploring The Role Of Islamic Fintech In Combating The Aftershocks Of Covid 19 The Open Social Innovation Of The Islamic Financial System Html

Jrfm Free Full Text Marketing Islamic Financial Services A Review Critique And Agenda For Future Research Html

Pdf Emerging Issues In Islamic Banking Finance Challenges And Solutions

Pdf Islamic Finance Challenges And Opportunities

Maximizing Islamic Finance For Financial Inclusion

Ta05346 Finance Islam Financial

Islamic Banking Products Regulations Issues And Challenges Semantic Scholar